Employee-Owned

Our Company - Our Future

ESOP = Employee Stock Ownership Plan

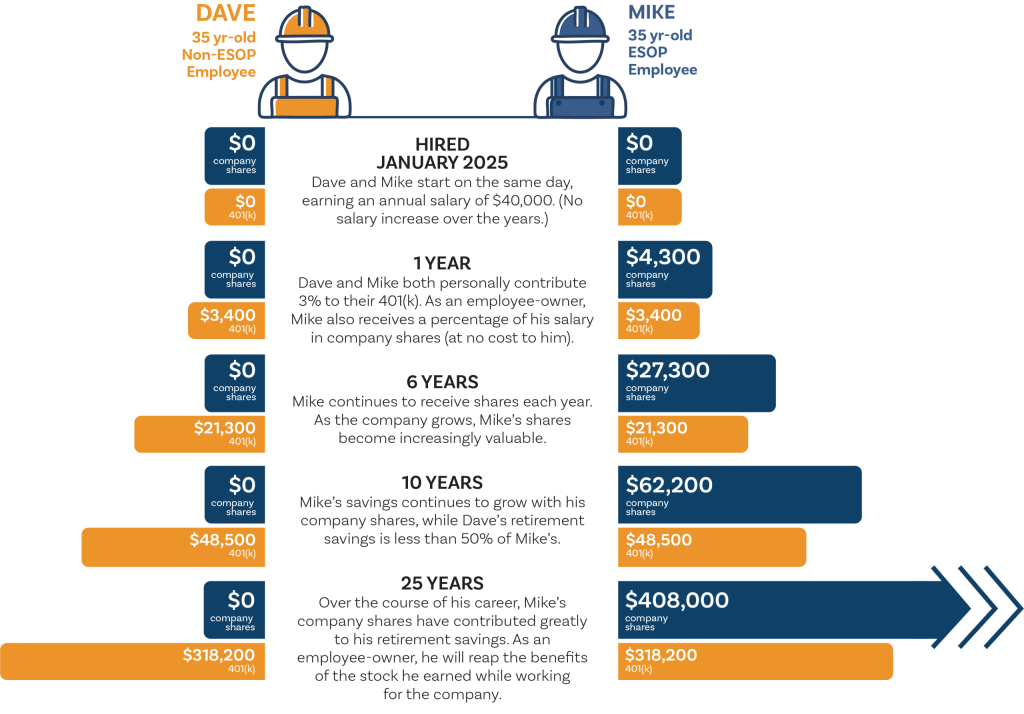

What does it mean to be “ESOP” or “Employee-Owned”? An Employee Stock Ownership Plan

(ESOP) is a retirement benefit that allows employees to become shareholders in the company—an opportunity provided at

no cost to them. At MGC, our employees collectively own 100% of the company.

What are the benefits of being part of an ESOP? Employee ownership fosters a strong alignment

between individual contributions and the company’s success. As employee-owners, we share a common purpose and are all

invested in the growth and performance of MGC. This collaboration drives business success, enhances company value, and

leads to increased share prices, translating into substantial financial returns for our employee-owners over time. In essence,

employee ownership paves the way for lasting wealth accumulation.

Our ESOP History

In 2016, MGC Contractors, Inc. transitioned to an Employee-Owned firm. This means that our profits are

shared proportionately amongst all our Employee-Owners. The result has been a staff of Employee-Owners

with an enhanced enthusiasm in their work and are deeply invested in the success of our business and the

practices which make it possible. This long-term commitment to the welfare of our stakeholders propagates

a company culture of unity and a shared vision for excellence in everything we do.

Frequently Asked Questions

- The ESOP provides you with the following:

- Retirement dollars

- Continuation for the Company

- A market for Company shares

- The opportunity for you to participate in the growth of the Company

You must be at least age 18 and work for MGC Contractors, Inc. for at least one full year of service and work 1,000 hours or more in that year. After completing these requirements, you enter the Plan on January 1 or July 1.

After joining the ESOP, you may be eligible to share in Company contributions that are used to acquire Company stock for your account. You are eligible to share in contributions for any year in which you work 1,000 hours AND are employed on the last day of the plan year (December 31), retired, became disabled or died.

A formula is used to determine how much of the total contribution is yours in any given year. Your contribution bears the same relationship to the total contribution as your Compensation bears to the total Compensation of all eligible participants in the ESOP.

For example, if your Compensation during a Plan Year is $40,000 and all Plan participants together have total compensation of $2,000,000, your account will be credited with $40,000/$2,000,000 or two percent (2%) of the total Company contributions, forfeitures and allocations of Company stock to be credited for that Plan Year. If the total allocation for that plan year is 2,500 shares, then you would receive 2 percent, or 50 shares.

Example: 2,500 shares x $40,000 / $2,000,000 = 50 shares

- You must become “vested” in your account balance before it is yours for good. You will receive a year of service for vesting for any year in which you work 1,000 hours or more. Years prior to age 18 are excluded.

- ESOP Vesting Schedule,

- 1 Year of Vesting Service, 0%

- 2 Years, 20%

- 3 Years, 40%

- 4 Years, 60%

- 5 Years, 80%

- 6 Years, 100%

- If you leave before you are 100% vested, the portion of your account that is not vested will be forfeited and shared by the remaining plan participants.

- Your account will vest 100% if the following occurs while you are employed at MGC Contractors, Inc.:

- You become permanently disabled

- You reach Normal Retirement Age

- Your death occurs

- You have two ways to retire from MGC Contractors, Inc.

- You reach Normal Retirement Age, which is the later of age 65 or 5 years of participation.

- You reach Late Retirement Age, which is anytime you decide to retire after you have passed Normal Retirement Age.